We’re not just another comparison site, we were founded with a mission—to place families at the centre of our work. That’s why we don’t throw as many quotes as we can at you and hope one sticks. Instead, we start with you, your story, your needs, your budget. Once we understand your unique circumstances, only then do we match you to a suitable quoting partner.

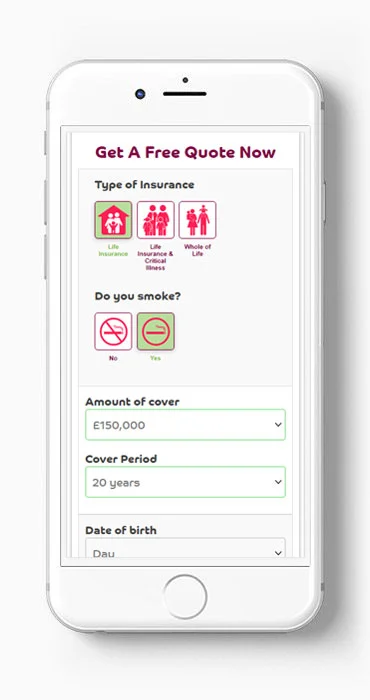

Simply tell us your details and needs by filling in this form. Don’t worry, if you don’t know which life insurance option is right for you, simply click “Not Sure”. The form will only take a few minutes.

We’ll match you to the most suitable partner we can find based on your unique circumstances and then a friendly, trained specialist will get in touch and guide you through the process.

Double, triple, quadruple check your proposed policy. Read the terms and conditions and consider carefully if this is an agreement you’d like to enter into.

Congrats! You’ve taken an important step towards protecting your family’s financial future. It’s time to tick “get life insurance” off your to do list.

"After seeing my aunt get stuck with an unaffordable funeral bill when my uncle died, I knew I didn’t want that to happen to my wife. My Life Insurance Online found me a whole of life quote—which means no matter how old I get the policy will pay out as long as I keep paying in—I like that I don’t need to think about life insurance ever again."

As long as you keep paying the premiums, whole of life cover provides a payout to your loved ones if you pass, regardless of when that happens. It’s a form of lifetime coverage and can accumulate cash value over time. The premiums are usually more expensive than those offered with term insurance.

Term insurance provides coverage for a specific period, for example, five, ten, twenty, or thirty years, meaning if you pass away within that period, the insurer will pay out. It’s a more affordable form of coverage, but it is only temporary and you will need to renew or switch your policy at the end of the term.

Critical illness insurance will pay out while you are alive if you are diagnosed with one of the life-threatening illnesses covered by the policy. For example, depending on the policy, you may be covered if you are diagnosed with cancer, heart disease, or a stroke. This can help manage income loss as you focus on getting better. Review your policy carefully so you understand which conditions are covered.

The last thing anyone needs when they’re diagnosed with a terminal illness is to worry about finances. Terminal illness benefit is an add on that can be purchased alongside life insurance that allows for an early payout if the insured person is given a limited life expectancy. Ask your insurer about the process before agreeing to a quote as it’s important to understand how you’ll prove qualification if you ever do need to claim on this feature.

If you and your partner take out a joint life policy, the policy covers both lives and will usually pay out to one of you if you the other dies while the policy is active. The policy would then end. This can be less expensive than taking out two separate policies and is an attractive policy for couples and business partners.

If a policy holder stops paying their premiums, a policy lapse can occur, which essentially gives the insurance company the right to cancel cover. This can have consequences both to your cover and to the cost of any future premiums. Always communicate openly with your insurance provider.

Quoted rates may vary and are subject to individual status and medical underwriting. Correct as of 2nd May 2024.

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

This depends on what you’re trying to achieve with life insurance. If you’re trying to achieve peace of mind, with end-to-end lifetime coverage and an accumulated cash value, whole of life might be more suitable. On the other hand, if you have a specific time-related need in mind, for example, you’re raising a small family and you’d like to protect them in case you unexpectedly pass within the next twenty years, or if you’re paying off a mortgage and you want to ensure the mortgage is still paid in case your partner is left alone, term insurance might suit you more.

There’s one vital thing to understand when searching for life insurance—payouts are not guaranteed. Now, while insurers do pay out on 98% of policies (with the average payout standing at £73,578) it’s important to go in to a policy with your eyes wide open to ensure your family is informed and prepared if a claim is ever made.

For that reason, if you decide you’re happy with the provider we’ve matched you with, ask them these questions:

Tip: Once you find out how your family can claim, be sure to write all that information and file it somewhere your family can refer to.

Start from the beginning—explain how this works to me.

Essentially, you set up a policy, you pay monthly premiums, if you die while you’re covered the insurance company pays out the funds to your family (or other designated recipients) and that money is then used to cover income loss, pay off the mortgage, or pay university bills as your loved ones learn to adjust to life without you.

As a general rule of thumb, the younger (and healthier) you are when you take out life insurance, the lower the premiums. This is because the chances of you dying are reduced. Smoking can increase the cost of your premiums and missing payments can result in a cancelled policy.

Life insurance is available to those over 50, in fact, some life insurance policies are tailored specifically to people enjoying their golden years. These policies are usually called “over 50s plans” However, do be aware that the premiums may be higher. Feel free to submit your information here and we’ll find you a suitable quoting partner.

You may still be able to find life insurance when you have a pre existing condition, however, it’s important to be 100% transparent so you don’t end up paying out for a voided policy. Depending on the severity of your condition, premiums may be higher. Submit your details here and we’ll match you to a suitable partner

The cost of life insurance varies, however, as an example, a non-smoking 30 year old, looking for a payout amount of £150,000, covering 30 years, would likely pay an average of around £6.98 per month.

However, this is just an example, quotes depend on a variety of factors including your age, lifestyle, occupation, and health. To find a more accurate quote, fill in the form here and someone will get back to you.

The answer to this question depends heavily on your personal circumstances. Everyone is different, but popular reasons for taking out life insurance include:

*The use of the provider logos does not mean endorsement by mylifeinsurance.online of products supplied by these providers and is for illustrative purposes only.