At MyLifeInsurance.Online our aim is to help you find the right life insurance policy to suit you and your family’s needs.

We’re not your typical comparison site. We learn a little bit about you and put you in touch with one of our specially selected panel of FCA-authorised partners whose trained experts will help you select the right policy.

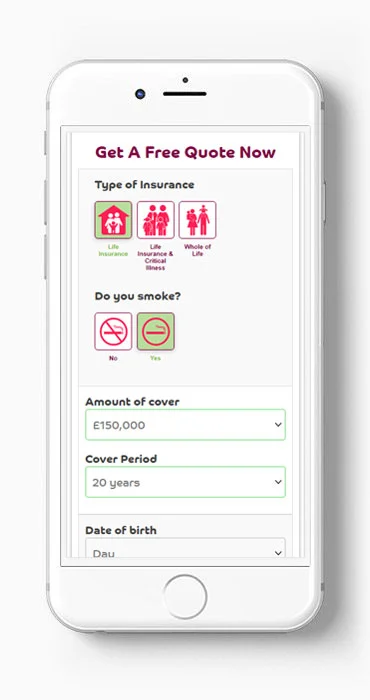

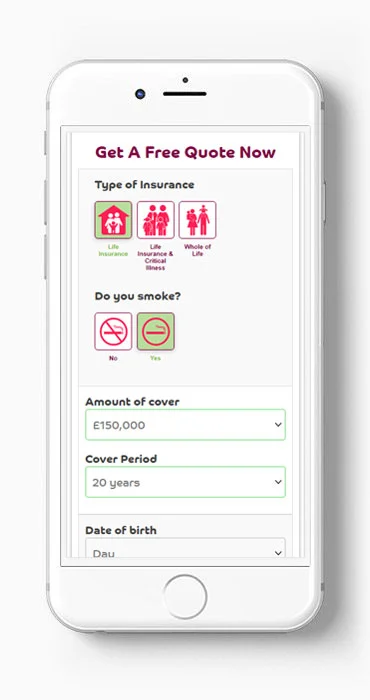

Fill out our quick online application, which can be done in under 60 seconds.

Connect with one of our specialists who will guide you through the essential details.

Make sure you are happy with the policy that your provider supplied.

Kick back and unwind, knowing your coverage is active.

Whole of Life is designed to last as long as you do. The premiums will continue as will the cover until the policy holder dies. Upon death the policy will pay out the specified sum. If the policy holder stops paying premiums then the policy coverage will end.

When you buy a term life policy, you are buying a promise from an insurance company that it will pay your beneficiaries a set amount if you die during the policy’s term.

Decreasing term insurance is life insurance designed to cover a mortgage or other significant debt amount that is repaid by the policy holder on a monthly basis. These plans will reduce in value over time and should be regularly reviewed to ensure the cover amount remains sufficient.

Critical illness insurance gives a lump sum for a diagnosis of the critical illnesses listed in the contract, things like cancer, coronary artery bypass surgery, heart attack and stroke.

A ‘joint‘ life policy covers two lives, usually on a ‘first death’ basis. This means the chosen amount of cover is paid out if the first person dies, during the policy, after which the policy would end.

Generally, income protection is a monthly benefit that pays around 75% – 85% of your income while you’re unable to work, based on your earnings prior to claim.

Quoted rates may vary and are subject to individual status and medical underwriting. Correct as of 2nd May 2024.

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

non-smoker in good health

Life insurance is designed to help your loved ones cope financially when you die. Cover provides help to your family when they are no longer receiving money from your salary.

The funds can be used to pay off any remaining mortgage(s) or any other everyday expenses.

Your quote will be dependant on certain features of your policy, the size of the sum to insure and also your perceived risk – your job/hobbies etc.

Age is a factor. Life cover will be more expensive for an older applicant, additionally, somebody suffering from certain medical conditions may expect higher monthly premiums.

Numerous details are used to calculate the cover premium, including location, hobbies, occupation, lifestyle (health, weight, fitness etc)

Policy changes are generally accepted, however keep in mind your premium could increase after amendments.

Any major changes, such as getting married, moving home or a new addition to the family should update your existing policy, and make sure it meets your current family dynamic, need, or situation. You could also consider what other protection you have in place. This includes income protection, which covers you or your partner if you’re unable to work, or critical illness cover. It’s always a good idea to get a personalised quote to see if your current insurance is the best option that’s available to you.

Critical illness cover provides a payout in the event of the policy holder becoming diagnosed with any of the defined illnesses noted in your policy schedule during the policy term. Different providers offer different levels of cover and for different illnesses, so it is important you chose the cover that best suits your needs.

Payout amounts are often based on the severity of the illness. Should you receive a partial payout your cover will remain in force, often covering the remainder of the sum assured and until the end of the policy term.

The amount of cover you require will depend on your personal circumstances. This amount will differ for each individual or family and can be based on a multiple of salary, overall amount of debt or a combination of the two.

Life insurance may also be used to provide additional inheritance to your loved ones or to cover an amount of inheritance tax you expect they will need to pay. The amount of cover you decide may be subjected to checks to ensure the policy holder is not over insured and the selected policy is fit for purpose.

The premiums on a life insurance policy are calculated using a number of factors. Selecting the right amount of cover will have a great effect on the price you will pay. Also the longer the policy the larger the premium.

Your general health is a key factor to consider. People who smoke, or are overweight for example will be viewed as a higher risk. Therefore keeping yourself at a healthy weight and quitting smoking can save you money on your premium.

The majority of policies have fixed premiums throughout the length of the term. Some policies are classed as ‘reviewable’, this form of cover is generally reviewed every 5-10 years and prices change to reflect the review.

You can elect to include index linking to some policies. This is where the amount you are insured

for increases each year in order to reduce the impact of inflation against the policies value. If

this option is selected then your premium is also likely to increase at each annual review.

*The use of the provider logos does not mean endorsement by mylifeinsurance.online of products supplied by these providers and is for illustrative purposes only.